Whoa! I’ve been staring at my wallet balances more than I care to admit. Seriously—sometimes it feels like juggling plates while riding a scooter down Market Street. At first I thought tracking crypto was just about prices. But then I dug deeper. My instinct said: there’s more risk in not knowing your on-chain positions than in the market volatility itself. Hmm… that gut feeling pushed me to rethink how I track tokens, manage NFTs, and keep staking rewards tidy on Solana.

Here’s the thing. Portfolio tracking isn’t glamorous. It’s bookkeeping for your on-chain life. But get it right and you save time, lower risk, and see opportunities sooner. Get it wrong and you end up missing rewards, stressing about phantom assets, or worse—sending tokens to the wrong place because you couldn’t tell which account held what.

I’ll be honest: I’m biased toward non-custodial control. I like the power and responsibility of managing keys. That said, convenience matters too, especially when NFTs and staking complicate the picture. Below I share practical approaches that have worked for me and for folks I trust in the Solana community—no fluff, just what helps you keep clean records, claim rewards, and avoid dumb mistakes.

Why portfolio tracking on Solana is its own animal

Solana moves fast. Transactions confirm in seconds; new token mints and NFT drops appear every day. That’s exhilarating. And chaotic. On one hand you have low fees and speed. On the other, you can very quickly accumulate tiny balances, a handful of stake accounts, and a gallery of NFTs scattered across associated token accounts.

So what matters? First, single-source visibility. You want one place that can show your SPL tokens, native SOL balance, stake accounts, and NFTs without you manually checking a dozen explorer tabs. Second, transaction clarity—those big metadata events that affect royalties, transfers, or delegated staking should be visible. And finally, actionable alerts—unstaked rewards, gasless airdrops, or incoming transfer warnings.

Tools help, obviously. But choose tools with open, auditable behavior. Ask: does the tool read-only access my accounts, or does it require key custody? For many power-users I know, the sweet spot is a wallet app for signing and a separate tracker that reads wallet addresses (no keys required) to show balances and portfolio performance.

Also—oh, and by the way—make sure your tracker supports NFTs properly, not just token counts. NFTs have metadata: creators, royalties, traits, and off-chain assets that matter. A tracker that lumps NFTs in with tokens will lose you context fast.

Practical routines: daily, weekly, monthly

Daily: quick 60-second check. Look for incoming transfers and big price swings. Confirm your SOL balance is healthy enough to cover future transactions.

Weekly: reconcile staking rewards and validator performance. Look for missing rewards and re-delegate if your chosen validator gets unhealthy. On Solana, validators matter—some churn more, some slash (rarely), and some simply underperform.

Monthly: deep audit. Export transaction history, map NFTs to marketplaces you use, and snapshot your key stake accounts. I still keep a simple spreadsheet—old-school, I know—but it’s saved me when I needed to prove ownership or reconstruct a tax report.

NFT management—more than just a pretty image

NFTs aren’t just collectibles; they’re keys to access, memberships, and sometimes revenue streams. So manage them like assets. Catalog provenance, check royalties settings, and keep tabs on off-chain links. If a metadata URL goes down, the value could degrade. So back up important metadata—safeguard what’s valuable to you.

Also: curate. Split the gallery into «active» and «archive» buckets. Move seldom-used pieces into a cold address if you want to insure, or keep them visible if you’re engaging with marketplaces or communities. I’ve moved some pieces to a hardware wallet because they had long-term value; others I keep in a hot wallet for quick trades.

Staking rewards—don’t leave money on the table

Staking on Solana is pretty straightforward but easy to mismanage. Rewards accumulate into stake accounts and depending on your setup you might need to claim or re-delegate to make those rewards work for you. Watch for activation/deactivation timing: stake changes often depend on epoch boundaries, not instant confirmations. That timing nuance is the difference between earning an extra epoch of rewards or missing it.

Validator selection matters. Look at uptime, commission, and community reputation. Higher commission can be fine if the validator is super stable and provides additional benefits (like community airdrops), but don’t ignore performance metrics. Rotate if your validator becomes unreliable. And yes—diversify. Splitting stake across validators reduces the single-point risk.

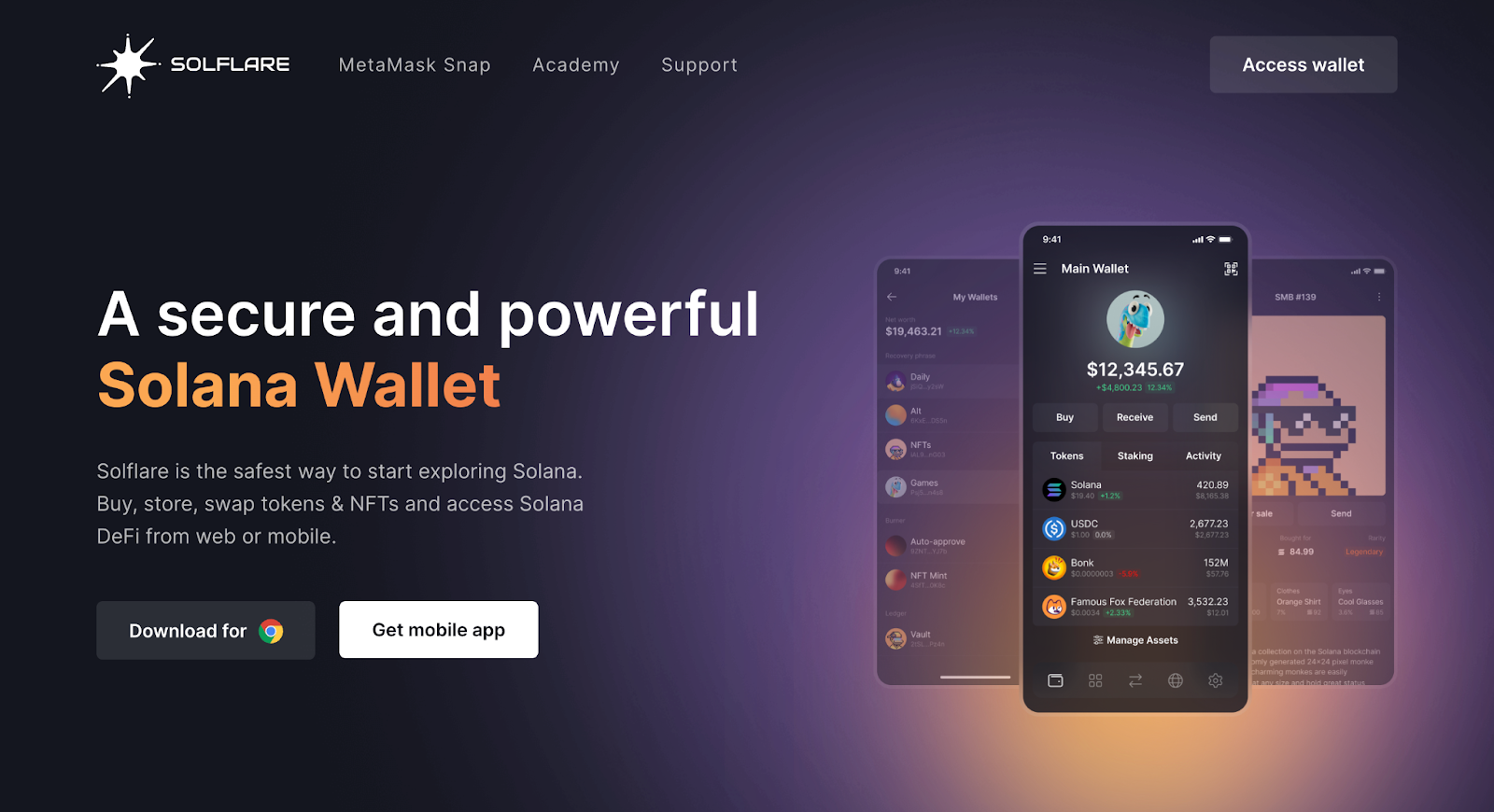

Solflare and the happy middle ground

If you’re looking for a wallet that balances UX with control, check out solflare wallet. It’s one of those options that supports staking natively, handles NFTs cleanly, and gives you clear visuals so you can reconcile holdings quickly. I’ve used it for cold storage setups and for quick staking moves when needed—works well, and it’s designed with Solana’s quirks in mind.

Oh—quick caveat: always verify you’re on the correct domain and official app or extension. Phishing is real. Keep your seed phrase offline and consider hardware wallet integration for larger positions.

FAQ — fast answers

How do I keep NFTs and tokens in the same tracker?

Use a tracker that reads the address and decodes SPL token accounts and Metaplex metadata. Many trackers show token balances plus an NFT gallery view—choose one that surfaces metadata and marketplace links.

Can I stake from multiple wallets and still track everything?

Yes. Aggregate trackers accept multiple public addresses. Keep a naming convention for each wallet so you don’t mix personal and project funds. Export histories periodically so you can reconcile across services.

What’s the simplest way to avoid losing staking rewards?

Automate your checks: weekly reminders to confirm validator health and reward accruals. Use a wallet or tracker that displays pending lazy rewards clearly. And don’t forget epoch timing when planning deactivations.